Welcome to Learning Engineer! My name is Michael, and I'm your host. If you need to reach me, you can email me at michael.langdon@learningengineer.com. Today, I'm going to show you how to set up a template-like file that allows you to quickly enter information into a document you've already set up. Here's how we're going to do it: First, we're going to click on the "Insert" tab, which is located at the top of the page. Then, we'll navigate to the "Quick Parts" section and click on the bottom part of it. This will open up a drop-down menu, and we want to select "Field." Next, we need to decide where we want to insert this field. In this case, we're going to delete what's currently there and click on the blank space. After clicking on "Quick Parts" again, we'll select "Field." A pop-up window will appear, and we want to scroll down until we find "Macro Button" and click on it. Once it's highlighted, we'll look for the "Field Codes" button and click on it. Now, we want to select the text that appears and either click and drag across it or double-click on it. We're going to type "No Name" in brackets like this: [No Name]. Since we plan to reuse this, we can hold down the "Ctrl" key and tap the "C" key to copy it. After that, we'll click "OK." You'll notice that it adds a text that says "Click here to enter your name." If you click in that area, it will highlight the text, and you can start typing in your name. The same process can be used for adding information in other fields. Additionally, you can modify the formatting of the text. For example, you can change the font size to 11 and make it italicized. Any formatting changes...

Award-winning PDF software

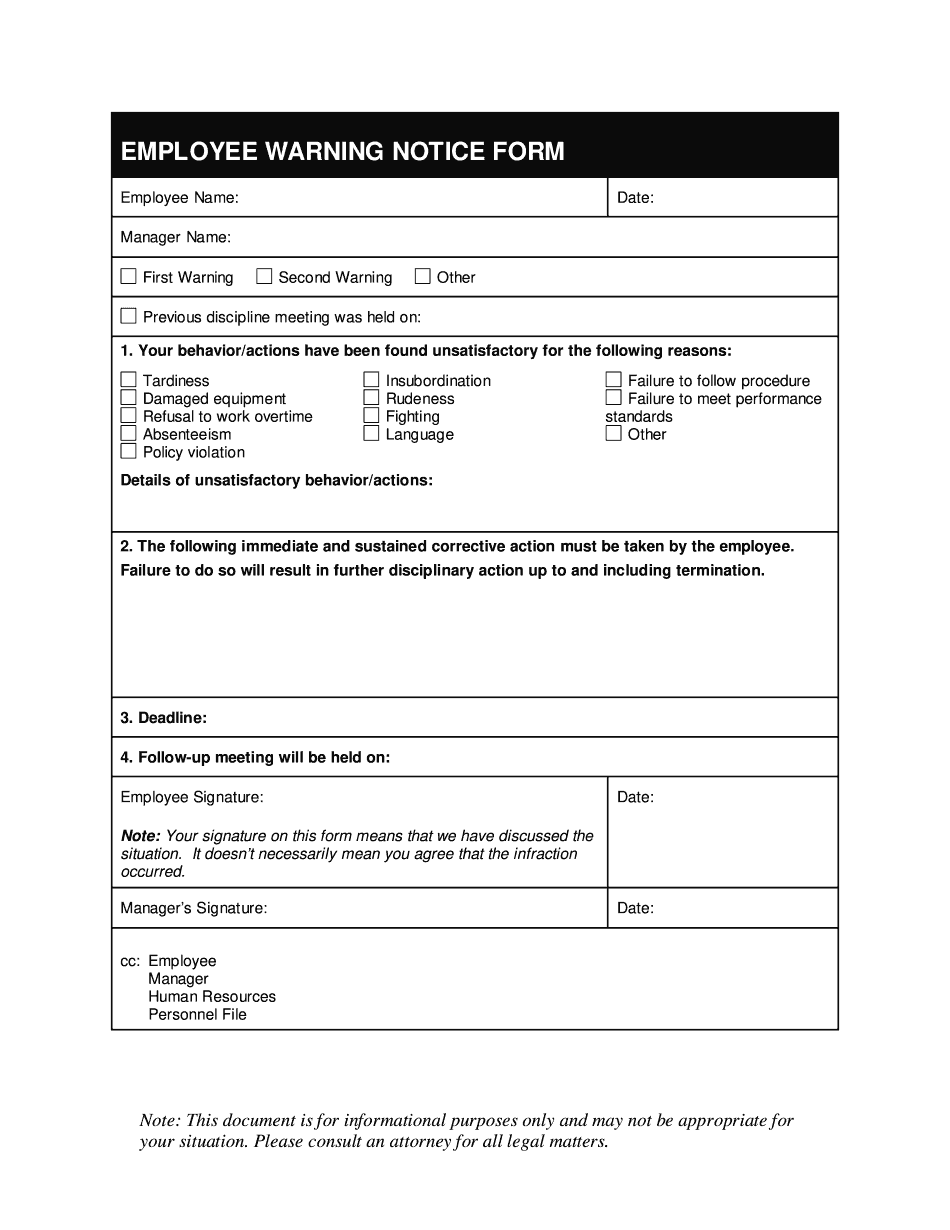

Printable employee write up Form: What You Should Know

Download. IRS Forms and Schedules. FAST Statement of Standards and Best Practices. 2018 Federal Income Tax Rates and Rates for Estates and Trusts 2015 Form 1040A Individual Income Tax Return 2015. Form 1040A. 2015. U.S. Individual Income Tax Return. Department of the Treasury—Internal Revenue If you have a P.O. box, see instructions. Apt. No. Form. 1040A-S (Single/Married to One). 2015. Form 1040A Statement of Standards and Best Practices. Department of the Treasury — Internal Revenue If you have a P.O. box, see instructions. Note to the Form 1040A: if you do not have an annual allowance or deduction for self-employment, you may be liable for self-employment tax. See self-employment tax. You can also use Form 1040A with a Form 1040, line 24, to report interest earned that is exempt from taxation. You will not be liable if you do not file a tax return on a timely basis. If you was liable, file a tax return on time. For more information refer to the instructions (TIP #12-11-9). 2015 Form 1042 (Electronic Filing of Income Tax Returns) 2015. Form 1042. 2015. Electronic Filing of Income Tax Returns. Department of the Treasury — Internal Revenue Form 1042-S (Single) or Form 1030-S (Joint) or (W-2G (Gross Adjusted Gross Income) (see Instructions on Form 1042 here or here). 2016 Federal Filing Expiration Date 2016 Federal Income Tax Return 2016. Form 1040. 2016. U.S. Individual Income Tax Returns. Department of the Treasury—Internal Revenue If you have a P.O. box, you must use Form 1040-A, 1040A-S, or 1040ED for your income tax return. See Forms and Schedules. You will be a liable for income taxes. If you have a P.O. box, you cannot complete Form 1040A without an annual allowance. See allowances and disallowances. You can use Form 1040A if you do not have an annual allowance or a deduction. Report income on line 7 of Schedule A, line 1 of Form 1040, or line 14 of Form 1040A-S.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Employee Warning Notice, steer clear of blunders along with furnish it in a timely manner:

How to complete any Employee Warning Notice online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Employee Warning Notice by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Employee Warning Notice from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Printable employee write up form